Apr 18, 2024

Poolcover: The Benefits of Keeping Your Pool Covered

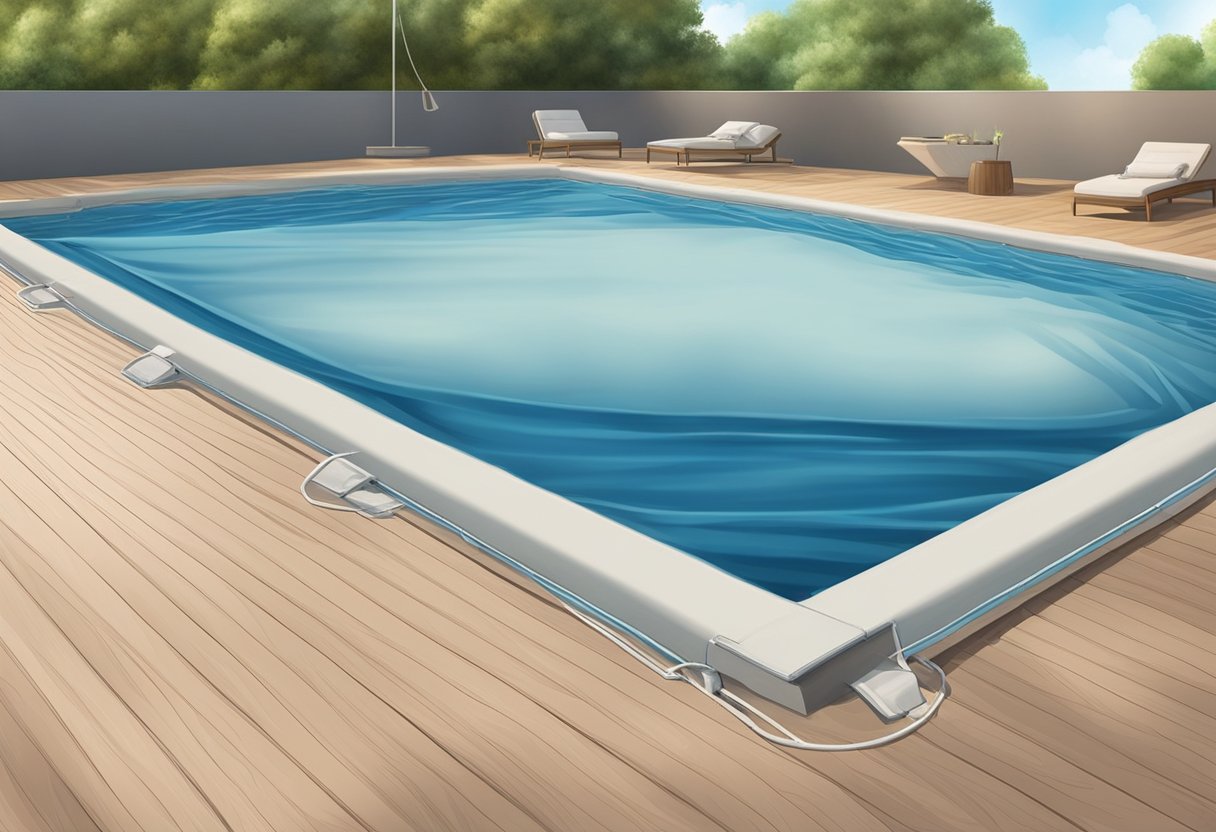

A pool cover is a simple yet effective tool that can help pool owners save time, money, and energy. By covering the pool when it’s not in use, pool covers can help keep debris out of the water, reduce evaporation, and even help keep the water warm. With a variety of pool cover options available, including thermal, child safety, and automatic covers, it’s easy to find one that suits your needs and budget.

One of the most popular types of pool covers is the solar pool cover, which uses the sun’s energy to warm the water. These covers are made from a special material that traps the sun’s heat, creating a greenhouse effect that can raise the water temperature by several degrees. Solar pool covers are also great for reducing evaporation, which can help pool owners save money on water and chemicals. Additionally, using a pool cover blanket can help protect your cover from UV rays, which can cause it to fade or crack over time.

Another type of pool cover is the safety cover, which is designed to prevent accidents and keep children and pets safe. These covers are made from a strong, durable material that can support the weight of a person or animal, and they are secured to the pool deck with anchors. Safety covers can also help keep debris out of the water, making them a great choice for pool owners who live in areas with lots of trees or other sources of debris.

Types of Pool Covers

When it comes to pool covers, there are several types to choose from. Each type has its own unique features, benefits, and drawbacks. Here are the four main types of pool covers:

Automatic Pool Covers

Automatic pool covers are the most expensive option, but they offer the most convenience. These covers are motorized and can be opened and closed with the push of a button. They also provide excellent safety, as they can support the weight of several adults.

Manual Pool Covers

Manual pool covers are less expensive than automatic covers, but they require more effort to use. These covers are typically made of vinyl or mesh and are pulled over the pool by hand. They are a good option for those on a budget who don’t mind a little extra work.

Safety Pool Covers

Safety pool covers are designed to prevent accidental drownings. These covers are typically made of mesh or solid vinyl and are anchored to the pool deck with straps and springs. They are strong enough to support the weight of several adults and are a good option for families with young children or pets.

Solar Pool Covers

Solar pool covers are a more economical option that can help reduce heating costs. These covers are made of a special material that traps the sun’s heat and transfers it to the pool water. They also help reduce water evaporation and keep debris out of the pool.

Overall, choosing the right pool cover depends on your budget, needs, and preferences. Consider the features and benefits of each type before making a decision.

Benefits and Considerations

Energy Efficiency

One of the primary benefits of installing a pool cover is the increased energy efficiency it provides. By reducing the amount of heat and water lost through evaporation, pool covers can help lower energy costs and decrease the need for chemical treatments. Solar pool covers, in particular, are designed to absorb and retain heat from the sun, which can keep the pool water warm without the need for additional heating systems.

for more info: https://www.poolcover.co.za/

More Details